Saudi Arabia's Public Investment Fund (PIF), the kingdom's $700 billion sovereign wealth fund, has been quietly building substantial positions in leading U.S. technology companies as part of a strategic bet on the artificial intelligence revolution. According to recent regulatory filings and financial analysts, the Middle Eastern fund has significantly increased its exposure to American tech giants and emerging AI players during the second quarter of this year.

The moves come as global investors scramble to position themselves for what many believe will be a transformative decade for artificial intelligence technologies. "The Saudis aren't just dipping their toes in the water - they're making a serious commitment to AI through these tech investments," said Miriam Kaufmann, senior technology analyst at Bernstein Research. "This reflects their broader economic transformation goals under Vision 2030."

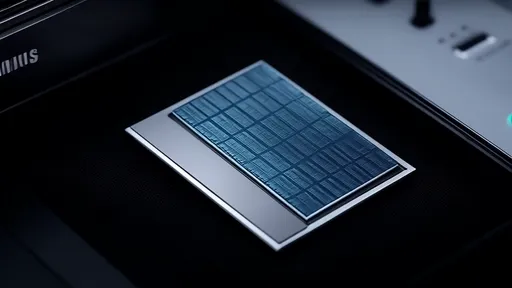

PIF's most notable new positions include substantial investments in semiconductor companies that produce chips essential for AI processing. The fund has taken sizable stakes in both established players and smaller firms specializing in AI accelerators and next-generation computing architectures. These chip investments suggest the Saudis understand that the AI revolution will be built, quite literally, on silicon.

Beyond hardware, the sovereign wealth fund has been accumulating shares in cloud computing providers and software companies developing enterprise AI solutions. While avoiding direct competition with Saudi Arabia's own growing tech sector, PIF appears to be targeting firms that provide the infrastructure and tools enabling AI adoption across industries. This balanced approach allows them to benefit from AI's growth without overconcentrating in any single segment.

The investment strategy mirrors Saudi Arabia's ambitious domestic technology initiatives, including the planned $500 billion NEOM smart city project which intends to incorporate AI at every level. By gaining exposure to leading U.S. tech firms, PIF can potentially transfer knowledge and partnerships back to Saudi tech ventures while earning returns from the global AI boom.

Shifting Investment Priorities

PIF's growing tech portfolio represents a notable shift from the fund's traditional focus on energy and domestic infrastructure projects. While oil-related investments remain important, the fund's managers have clearly identified AI and advanced computing as critical to future economic growth. This transition aligns with Crown Prince Mohammed bin Salman's Vision 2030 plan to diversify the kingdom's economy beyond petroleum.

The sovereign wealth fund's U.S. tech investments are being closely watched on Wall Street, where some analysts view Saudi Arabia's moves as validation of the AI sector's long-term potential. "When a fund with PIF's resources makes these kinds of concentrated bets, it sends a strong signal to the market," noted James Rutherford, head of global technology strategy at Morgan Stanley.

Interestingly, the Saudi investments come at a time when some U.S. politicians have expressed concerns about Middle Eastern influence over American technology. However, PIF appears to be carefully structuring its investments to avoid triggering regulatory scrutiny, generally keeping individual stakes below the thresholds that would require special approvals.

Long-Term Play on AI Adoption

Unlike hedge funds that might trade in and out of tech stocks rapidly, PIF's investment horizon appears measured in years rather than quarters. The fund's managers have emphasized that they're positioning for the gradual adoption of AI across multiple industries rather than short-term hype cycles. This patient approach reflects both the sovereign wealth fund's long-term liabilities and Saudi Arabia's multi-decade economic transformation plans.

The AI investments also complement PIF's growing portfolio of international venture capital and private equity stakes in technology startups. By combining public market positions with private company investments, the fund gains exposure to AI innovation at multiple stages of development. This diversified approach helps mitigate risk while capturing upside potential across the technology stack.

Financial analysts note that PIF's tech investments are still dwarfed by its massive domestic projects and traditional holdings. However, the deliberate buildup of U.S. tech positions suggests this will become an increasingly important part of the fund's overall strategy. As AI begins transforming industries from healthcare to manufacturing, Saudi Arabia wants to ensure it benefits financially while gaining technological insights that can aid its own economic diversification.

Geopolitical Considerations

The investment push comes amid complex geopolitical dynamics between Saudi Arabia and the United States. While the two nations remain important allies, their relationship has shown strains in recent years over oil production policies and other issues. Some analysts speculate that increasing economic interdependence through technology investments could help stabilize bilateral relations.

At the same time, Saudi Arabia is carefully navigating the growing tech rivalry between the U.S. and China. By focusing its AI investments primarily on American firms rather than Chinese tech companies, PIF appears to be aligning with Western technological ecosystems despite Saudi Arabia's maintained economic ties with Beijing.

The sovereign wealth fund's growing tech portfolio may also provide Saudi Arabia with increased influence in global technology circles. As a significant shareholder in multiple AI-related companies, PIF could gain access to executive leadership and early insights about technological developments. This soft power aspect shouldn't be underestimated in an era when technological leadership translates directly into geopolitical influence.

Domestic Tech Ecosystem Development

PIF's international tech investments run parallel to its efforts to build a domestic technology sector in Saudi Arabia. The fund has been actively financing homegrown tech startups and partnering with international firms to establish regional research centers and innovation hubs. Knowledge transfer from its U.S. tech holdings could accelerate these domestic initiatives.

The kingdom has particularly ambitious plans for AI adoption in government services and urban development. Projects like NEOM are intended to showcase Saudi Arabia's technological ambitions while attracting international talent and investment. PIF's U.S. tech positions provide both financial exposure to the AI revolution and potential partnerships for these domestic ventures.

Some industry observers suggest that Saudi Arabia's tech investment strategy resembles Singapore's Temasek model, where a sovereign wealth fund actively shapes national economic development through strategic holdings. However, the scale of Saudi Arabia's ambitions and resources makes PIF's moves particularly significant for global tech markets.

Market Impact and Future Outlook

While PIF's individual tech holdings are substantial, they remain small relative to the overall market capitalizations of major U.S. tech firms. Nonetheless, the fund's consistent buying has provided support for tech share prices during periods of market volatility. More importantly, Saudi Arabia's endorsement of AI as a transformative technology reinforces the investment thesis driving much of the sector's valuation.

Looking ahead, analysts expect PIF to continue building its U.S. tech portfolio, potentially expanding into adjacent areas like quantum computing, robotics, and biotechnology as these fields converge with artificial intelligence. The fund may also increase its participation in late-stage private funding rounds for AI companies before they go public.

For Saudi Arabia, the tech investments represent both a financial opportunity and a strategic imperative. As the world transitions to a knowledge-based economy, the kingdom is determined to avoid being left behind. By positioning its sovereign wealth fund as a major investor in AI technologies, Saudi Arabia aims to secure both financial returns and technological relevance in the coming decades.

The full implications of PIF's tech investment strategy will take years to unfold. What's clear is that one of the world's largest pools of capital has identified artificial intelligence as a critical focus area - a conviction that will likely influence investment trends and technological development far beyond Saudi Arabia's borders.

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Sep 15, 2025

By /Aug 12, 2025