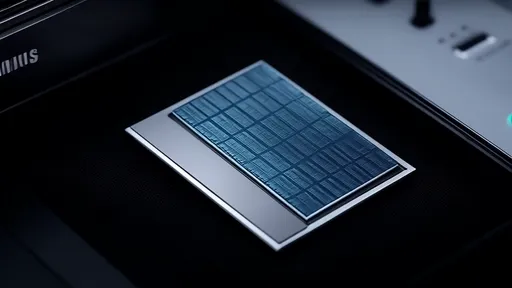

Samsung Electronics has reportedly achieved a significant breakthrough in its 3-nanometer (nm) chip manufacturing process, with yield rates surpassing 80%. This development marks a pivotal moment in the semiconductor industry, as it positions Samsung as a formidable competitor to Taiwan Semiconductor Manufacturing Company (TSMC), the long-standing leader in advanced chip production. The race to dominate the next generation of semiconductor technology is heating up, and Samsung's progress could reshape the global supply chain.

For years, TSMC has held an undisputed advantage in cutting-edge chip fabrication, particularly in the 3nm and 5nm segments. Major clients like Apple, NVIDIA, and Qualcomm have heavily relied on TSMC's superior yields and production capacity. However, Samsung's recent advancements threaten to disrupt this dynamic. The South Korean giant has been aggressively investing in its foundry business, aiming to capture a larger share of the high-performance computing (HPC), smartphone, and artificial intelligence (AI) markets.

The implications of Samsung's 80% yield rate are profound. In semiconductor manufacturing, yield—the percentage of functional chips per wafer—is a critical metric that directly impacts cost and scalability. Historically, Samsung struggled with lower yields compared to TSMC, which deterred some clients from adopting its advanced nodes. But with yields now reaching competitive levels, Samsung could attract more customers seeking alternatives to TSMC, especially amid growing geopolitical tensions and supply chain diversification efforts.

Industry analysts suggest that Samsung's progress is partly due to its adoption of Gate-All-Around (GAA) transistor architecture for its 3nm process. This technology, which replaces the traditional FinFET design, offers better performance and power efficiency. While TSMC has also been developing GAA, it opted to stick with FinFET for its initial 3nm production, potentially giving Samsung a temporary edge in certain applications. The competition between these two approaches will likely define the next phase of semiconductor innovation.

Market reactions to Samsung's announcement have been mixed. Some investors view this as a turning point that could erode TSMC's dominance, while others remain cautious, citing Samsung's past inconsistencies in execution. Nevertheless, the news has already spurred speculation about potential shifts in client allegiances. Companies like AMD, Google, and Tesla, which have been exploring multi-sourcing strategies, might now consider Samsung's 3nm process more seriously.

Beyond the immediate business implications, Samsung's breakthrough carries geopolitical significance. The U.S. and its allies have been pushing to reduce reliance on TSMC, whose facilities are concentrated in Taiwan—a region facing heightened geopolitical risks. Samsung's expanded capacity in South Korea and the U.S. (where it is building a $17 billion fab in Texas) aligns with Western efforts to secure a more resilient semiconductor supply chain. This could make Samsung an increasingly attractive partner for American and European tech firms.

However, challenges remain for Samsung. Maintaining high yields at scale is notoriously difficult, and TSMC's decades of experience in mass production give it a deep expertise that Samsung is still catching up to. Additionally, TSMC is not standing still—it plans to introduce its own GAA-based 2nm process by 2025, which could reclaim any technological lead Samsung might temporarily hold. The battle between these two titans is far from over, but one thing is clear: the semiconductor industry is entering a new era of intensified competition.

As Samsung ramps up its 3nm production, the broader tech ecosystem will be watching closely. From smartphone makers to AI developers, the availability of high-performance, energy-efficient chips is crucial for next-generation innovations. If Samsung can sustain its momentum, the balance of power in the semiconductor industry may indeed shift, ending TSMC's near-monopoly and ushering in a more diversified—and perhaps more competitive—landscape.

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Aug 12, 2025

By /Sep 15, 2025

By /Aug 12, 2025